Not known Facts About Payment Solutions

Wiki Article

The smart Trick of Payment Hub That Nobody is Discussing

Table of ContentsThe First Data Merchant Services IdeasThe Basic Principles Of Ebpp How Fintwist Solutions can Save You Time, Stress, and Money.Payeezy Gateway Can Be Fun For EveryoneThe Ultimate Guide To Credit Card Processing FeesEverything about Virtual TerminalGetting The Fintwist Solutions To WorkOur Online Payment Solutions IdeasThe Of Credit Card Processing Companies

One of the most common issue for a chargeback is that the cardholder can not keep in mind the purchase. However, the chargeback ratio is extremely low for deals in an in person (POS) atmosphere. See Chargeback Monitoring.You do not need to become a specialist, however you'll be a much better consumer if you recognize exactly how debt card handling really functions. Who are the stars in a debt and debit card purchases?

Some Known Factual Statements About Credit Card Processing Companies

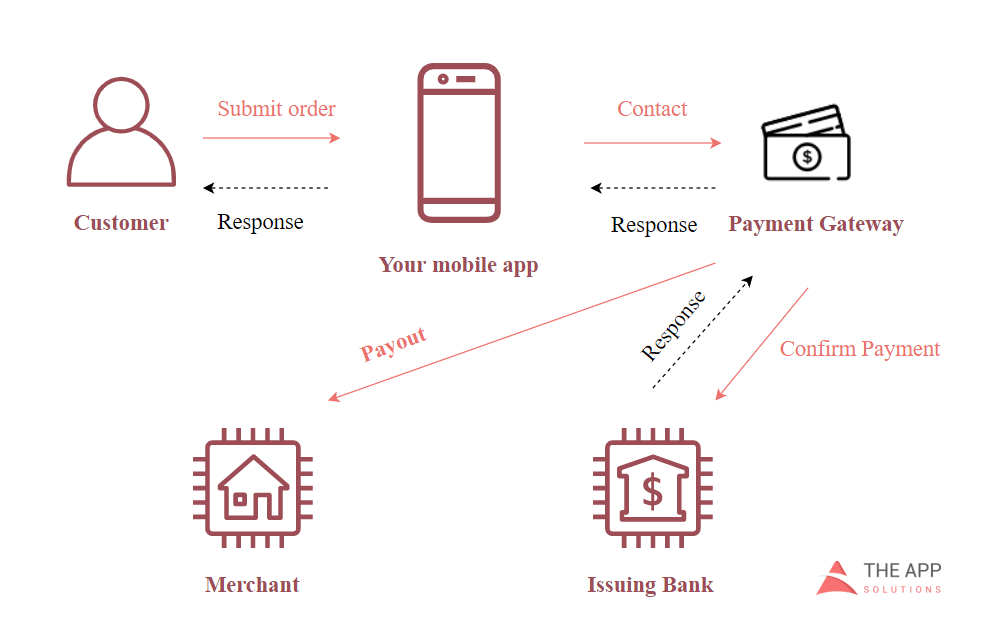

That's the credit score card process essentially. Now let's check out. send batches of authorized deals to their. The passes purchase details to the that interact the ideal debits with the in their network. The costs the make up the quantity of the transactions. The then transfers appropriate funds for the transactions to the, minus interchange charges.

Comdata Payment Solutions Fundamentals Explained

You can obtain a vendor account by means of a repayment handling firm, an independent service provider, or a big financial institution. Without it, you would have nowhere to keep the money your customers pay you. A settlement handling business or monetary institution takes care of the deals in between your clients' financial institutions and your bank. They take care of such concerns as credit score card credibility, offered funds, card restrictions, and so forth.You should enable sellers to gain access to info from the backend so they can watch background of repayments, cancellations, as well as various other deal data. You have to comply with the PCI Safety Requirements to supply internet site settlement handling remedies for customers. PCI Safety aids vendors, vendors, as well as banks implement standards for developing safe and secure settlement remedies.

5 Easy Facts About Credit Card Processing Explained

Pay, Chum, for example, is not subject to banking regulations, so it can freeze your account and as a result your cash at will (credit card processing companies). Various other drawbacks consist of high prices for some sorts of settlement processing, limitations on the number of transactions daily and also quantity per deal, and also safety openings. There's additionally a selection of on the internet click over here now repayment handling software application (i.

The Best Strategy To Use For Ebpp

seller accounts, occasionally with a payment gateway). These platforms differ in their compensations and also integration opportunities some software application is much better for bookkeeping while some fits fleet management best. An additional choice is an open source repayment handling platform. However do not believe of this as cost-free processing. An open source platform still needs to be PCI-compliant (which sets you back around $20k annually); you'll need to release it as well as keep a number of nodes; as well as you'll require to establish a connection with an obtaining bank or a repayment processor.The Facts About Clover Go Revealed

They can likewise make your cash money flow a lot more foreseeable, which is something that every little service proprietor aims for. Discover more just how about B2B settlements work, as well as which are the most effective B2B payment products for your tiny company. B2B settlements are repayments made in between 2 sellers for products or solutions.

The 9-Minute Rule for First Data Merchant Services

People included: There are several people included with each B2B deal, consisting of receivables, accounts payable, billing, and also purchase teams. Repayment delay: When you pay a buddy or member of the family for something, it's frequently ideal on-site (e. g. at the restaurant if you're dividing a bill) or just a couple of hours after the occasion.Because of the complexity of B2B repayments, increasingly more services are choosing trackable, electronic repayment options. Fifty-one percent of organizations still pay by check, decreasing from 81% in 2004. And 44% of businesses still obtain payment by check, declining from 75% in 2004. There are 5 primary means to send out and receive B2B repayments: Checks This classification includes standard paper checks as well as digital checks released by a purchaser to a seller.

6 Simple Techniques For Credit Card Processing Companies

Cord transfers These are funds transfers between financial institutions that are directed via a monetary network like SWIFT. Cable transfers normally supply money within hrs. Electronic financial institution transfers These are settlements between banks that are directed through the Automated Clearing Up House (ACH). This is just one of the best and trustworthy settlement systems, yet bank transfers take a few days longer than cable transfers.Each alternative differs in simplicity of use for the sender and also recipient, expense, and safety and security. That said, a lot of businesses are moving away from paper checks and relocating towards digital and digital settlements.

Rumored Buzz on Virtual Terminal

Repayments software and also applications have records that offer you an overview of your balance dues and also accounts payable. For instance, if Web Site there a couple of sellers that consistently pay you late, you can either impose stricter deadlines or quit working with them. B2B repayment options likewise make it less complicated for your consumers to pay you, aiding you get repayment faster.Report this wiki page